Welcome Back!

We hope you enjoyed the previous edition where we explored the transformative power of Robotic Process Automation (RPA) in analytics. This week, we dive into another critical topic: Fraud Detection Using Data Analytics.

Fraud Detection: Unlocking Insights Through Data

In a world driven by data, fraud detection has become a pivotal application for businesses across industries. Whether it’s financial transactions, e-commerce, or insurance claims, the risk of fraudulent activities looms large. Fortunately, data analytics empowers organizations to identify suspicious patterns and mitigate risks efficiently.

Fraud detection using data involves analyzing massive datasets to uncover anomalies, predict fraudulent behaviors, and implement real-time solutions. With machine learning and advanced analytics, businesses can not only detect fraud but also proactively prevent it, saving millions in potential losses while enhancing customer trust.

Recommended Reads

Balancing Security and User Experience to Improve Fraud Prevention Strategies

Explore strategies to achieve strong fraud protection without compromising user experience.Credit Card Fraud Detection with Different Sampling Techniques

Learn about various sampling techniques to handle imbalanced datasets for accurate fraud detection.Financial Fraud Detection Using Machine Learning: A Comprehensive Guide

A deep dive into machine learning applications for detecting and preventing financial fraud.What is Fraud Detection?

An introductory guide to understanding fraud detection and its importance in modern businesses.

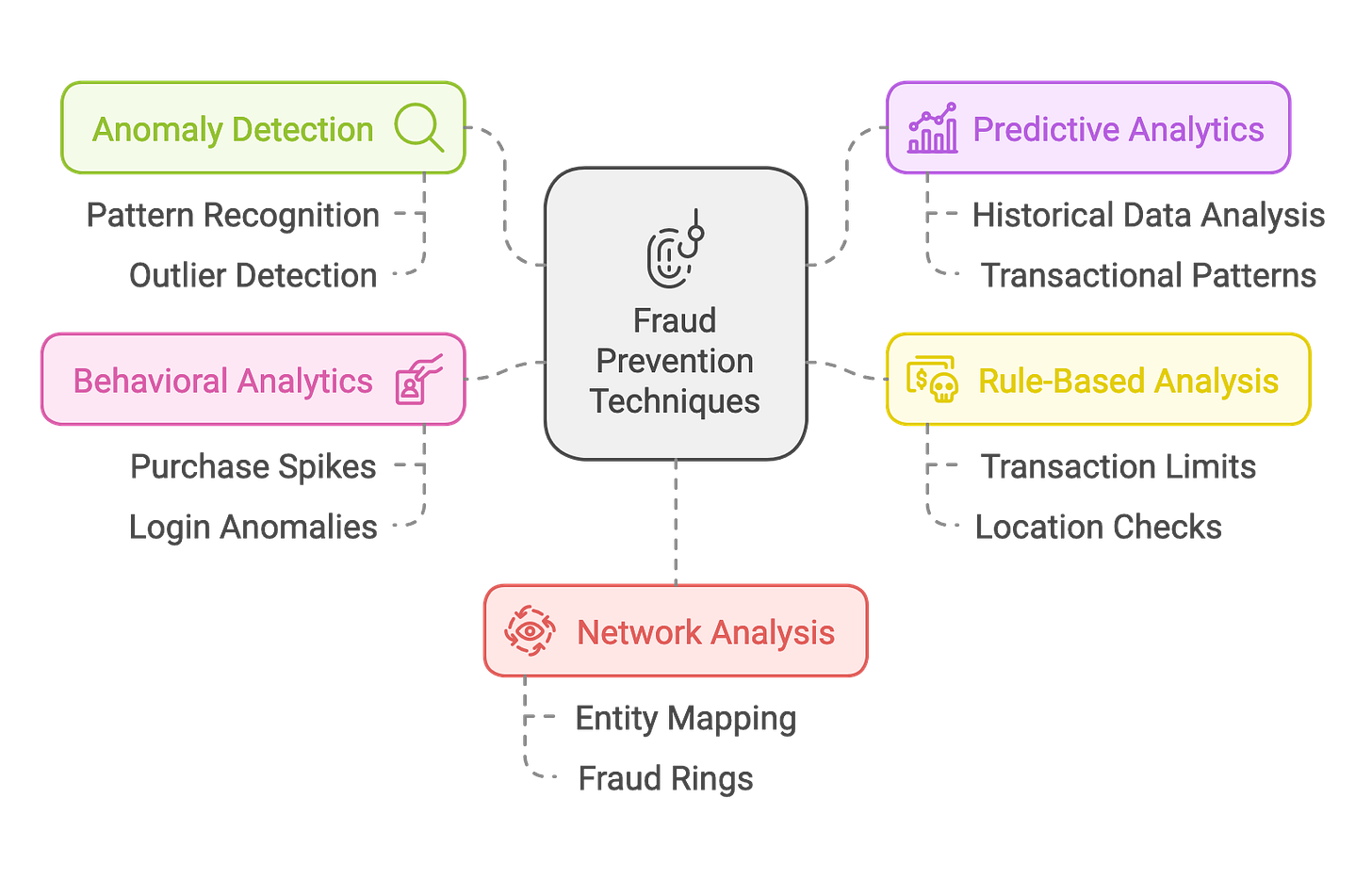

Techniques for Identifying and Preventing Fraudulent Activities

Here are some effective techniques to identify and combat fraud using data analytics:

Anomaly Detection: Algorithms analyze data to spot unusual patterns or outliers that deviate from normal behavior, triggering fraud alerts.

Predictive Analytics: Machine learning models predict the likelihood of fraud based on historical data and transactional patterns.

Rule-Based Analysis: Setting predefined rules (e.g., transaction limits, location checks) to flag suspicious activities automatically.

Behavioral Analytics: Understanding user behavior to identify deviations such as sudden spikes in purchases or login anomalies.

Network Analysis: Mapping relationships between entities (customers, devices, IP addresses) to uncover fraud rings and coordinated attacks.

Recommended Watch

How Can Machine Learning Detect Fraud?

This insightful video explains how machine learning algorithms identify and combat fraudulent activities efficiently.

Tool of the Day - SAS Fraud Management

SAS Fraud Management is a leading tool for real-time fraud detection and prevention. Leveraging advanced analytics and machine learning, it monitors transactions, detects anomalies, and minimizes false positives.

Pros:

Real-time fraud detection.

Scalable to handle large datasets.

Robust reporting and visualization capabilities.

Cons:

High implementation costs.

Requires skilled personnel for setup and management.

Read More: SAS Fraud Management

Fraud detection is no longer optional—it’s a necessity. By leveraging data analytics and advanced tools, organizations can safeguard their assets, protect customers, and build a more secure future.

Stay tuned for the next edition of Business Analytics Review. Until then, keep exploring and innovating!